On May 5, 2025, AI leader OpenAI confirmed a notable deal: the acquisition of AI coding tool startup Windsurf for approximately $3 billion. Not only is this OpenAI's biggest acquisition to date, surpassing previous acquisitions such as Rockset and Multi, but it also drops a bombshell in the highly competitive AI coding space.

News of the deal was first revealed by Bloomberg reporter Rachel Metz, and the two sides entered into negotiations a few weeks ago. For Windsurf's early investors, such as Kleiner Perkins, General Catalyst, and Greenoaks Capital, this is certainly a lucrative return. At the same time, the acquisition puts the spotlight back on the future of AI-enabled software development and OpenAI's determination to solidify its position in the multibillion-dollar market.

Who is Windsurf? Why was he chosen by OpenAI?

Windsurf, formerly known as Codeium, was founded in 2021 by MIT graduates and childhood friends Varun Mohan and Douglas Chen. Headquartered in California, the company specializes in building so-called "agentic" integrated development environments (IDEs). The core idea of such IDEs is to utilize artificial intelligence to deeply intervene and accelerate the entire process of generating, testing, and even debugging code, rather than simply patching it.

Windsurf's tools are claimed to support "vibe coding" - a concept co-founded by OpenAI co-founder Andrej Karpathy to mean that developers can quickly generate code with AI prompts that are more natural and biased toward describing intent.Windsurf Windsurf claims that its technology understands developer intent and improves the efficiency of specific development tasks by 30% to 40%. One of its core technologies is the "Cascade Flow" system, which analyzes the entire codebase to anticipate dependencies, optimize workflows, and reduce bugs - a capability that has earned it a spot on the Forbes AI 50 for 2025.

OpenAI was clearly impressed by Windsurf's technical potential, especially the prospect of integration with OpenAI's own models. It has been reported that Windsurf quickly integrated OpenAI's o3-Mini model prior to its acquisition to accelerate tasks such as codebase analysis and game logic generation. While its annualized recurring revenue (ARR) is reported to be around $40 million (with some reports suggesting closer to $100 million), its ARR has grown from $10 million to $40 million over the past two years by 300%, demonstrating strong growth momentum. Based on a $40 million ARR, the $3 billion purchase price implies a revenue multiple of up to 75x, far exceeding the price-to-sales ratios of traditional SaaS companies, and reflecting the hotness of the current market for AI tools.

The Considerations Behind Acquisitions: Price, Timing and Strategic Value

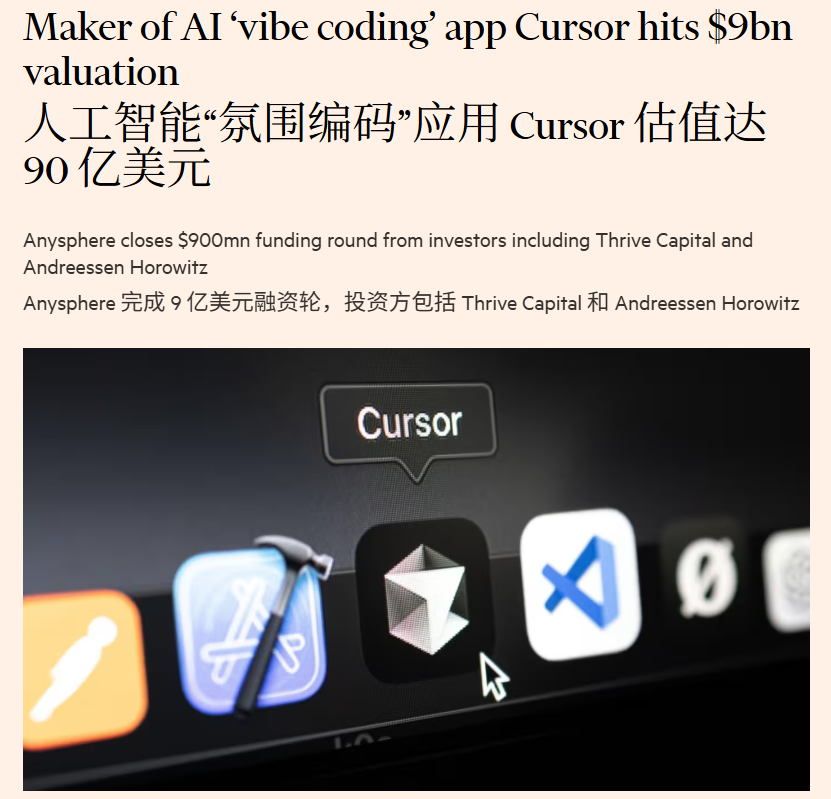

Before finalizing the acquisition of Windsurf, OpenAI was reportedly in contact with over 20 startups in the AI coding space. Among them was the star of the market, Cursor (Anysphere), which at one point was valued at up to $10 billion and had higher revenues than Windsurf (reportedly around $200 million). However, the high valuation and the potential conflict of OpenAI being an investor in Cursor itself ultimately put OpenAI's negotiations with Cursor on hold.

In contrast, Windsurf has shown more flexibility in its negotiations. Its $3 billion valuation, while still high (up from $285 million in its February 2025 funding round and $125 million in its 2023 funding round), is still within the realm of acceptability for OpenAI, which has a $40 billion "war fund". OpenAI Chief Product Officer Kevin Weil recently praised Windsurf's technical capabilities in a public video, setting the stage for the deal.

The choice to acquire rather than build reflects OpenAI's strategic urgency to quickly acquire mature technology and a user base to solidify its leadership in AI coding in the face of competitors such as Google and Anthropic. The acquisition of Windsurf will not only provide access to Windsurf's advanced technology, but also to valuable data on real-world coding tasks that can be used to improve OpenAI's underlying models.

Early stage investors have profited from this acquisition. Greenoaks Capital, for example, invested $60 million at a valuation of $26 million in Windsurf's seed round in 2021, and holds nearly 20% shares. At a purchase price of $3 billion, its return was nearly $600 million, a yield of nearly 10 times.

Market Landscape Reshaping and Potential Challenges

OpenAI's move will undoubtedly intensify competition in the AI coding tools market, with Windsurf's main competitor Cursor facing a strong challenge from newer giants backing it, even though its revenues are higher. Other players such as Microsoft's GitHub Copilot, Anthropic's Claude, Google's Agent Mode, and Bolt, Replit, and Vercel will also need to reassess market dynamics.

For OpenAI, the integration of Windsurf's technology is expected to significantly improve the coding capabilities of its flagship product, ChatGPT, as well as possible future developer tools (which may be directly benchmarked against GitHub Copilot). This is not just gaining a code assistant, but also an important step towards building a more complete AI full-stack solution, with the intention of covering the full range of scenarios from natural language interaction to professional code development, especially in the enterprise market and the expansion of the individual developer community.

However, the deal is not without its variables. Although the deal has been agreed upon, it has not yet been finalized. The U.S. Federal Trade Commission (FTC) is likely to conduct an antitrust review of the acquisition to assess whether it will have an adverse effect on competition in the marketplace. In addition, the purchase price may include a stock payment for OpenAI, which could affect the actual cash return to investors. The process of integrating the technology and the team, as well as how to address the code "hallucinations" that sometimes occur with OpenAI models such as o3, are also challenges that need to be overcome.

The next wave of AI coding?

Regardless, OpenAI's acquisition of Windsurf clearly demonstrates that AI-powered coding tools have become a key and indispensable part of the developer ecosystem. the AI coding assistant market, while still small in size in 2023 (~$18.6M), is expected to grow at a CAGR of 25.8% through 2030; while the broader AI coding tools The market is expected to grow from $4.3 billion in 2023 to $12.6 billion in 2028, indicating significant growth potential.

The combination of Windsurf's innovative technology with OpenAI's strong modeling capabilities and market resources signals an increasingly central role for AI in software development. In the coming months, the market will focus on the finalization of the deal, the attitude of regulators, and how OpenAI integrates Windsurf's technology into its product matrix. This acquisition is a catalyst for accelerated change in AI coding, and the fallout will be worth watching.